BLUF

Concepts introduced and amplified in the National Defense Industrial Strategy (NDIS) offer helpful frameworks for energy companies to reduce geopolitical risk. Adversarial capital, production diplomacy and friend-shoring each reflect a relevant attribute of the current global geopolitical situation.

Why does this matter?

The NDIS repeatedly illuminated how and why industry “must…consider the impact of their business practices on national security.” One way this was accomplished was via the introduction of new terms. Taken together, these new terms provide a north star to guide industry in ways to reduce their own geopolitical risk, while also strengthening industrial base resilience.

Modernizing the industrial ecosystem is vital to support Integrated Deterrence with our allies and partners.

Key Take-Aways

- Energy company investments and operations are put at risk when adversarial capital is involved.

- Production diplomacy reduces risk for companies engaged in it, including energy companies.

- Friend-shoring reduces geopolitical risk for energy companies.

Disclaimers: The views expressed in this article are those of the author and do not reflect the official policy or position of the Department of Defense or the U.S. Government. The appearance of external hyperlinks does not constitute endorsement by the United States Department of Defense (DoD) of the linked websites. The DoD does not exercise any editorial, security or other control over the information you may find at these locations.

Energy company investments and operations are put at risk when adversarial capital is involved.

Let’s start by clarifying two definitions. According to Merriam-Webster dictionary, “adversary” means one that contends with, opposes, or resists; an enemy or opponent. Similarly, the adjective “adversarial” refers to two sides who oppose other. As the National Security Strategy, National Defense Strategy and NDIS all make clear, the primary adversaries in question are the People’s Republic of China (PRC) and Russia.

A key attribute to adversarial capital is its deployment by individuals or groups to undermine or challenge existing power structures. To use language directly from the NDIS, adversarial capital could be employed in many ways. Below is a reformatted excerpt from page 44 of the NDIS:

“Below the level of armed conflict and in an era of strategic competition, adversarial nations are strategically employing investments in key U.S. and allied defense industries to:”

- harvest critical technologies,

- gain access to pioneering innovation and research and development efforts,

- leverage opaque private-public reporting structures to mask ultimate beneficial ownership (UBO), and

- capitalize on dual-use technologies that may be used to close the gap in the U.S. military’s comparative advantage.

Energy companies must consider all that and then some.

Adversarial capital could lead to intellectual property (IP) theft. That theft could be covert and stay undiscovered. It could also occur in a more overt, deliberate fashion. Recall authoritarian rulers do not always follow the current norms of the rules-based international order. Indeed, those wielding adversarial capital seek to change existing power structures.

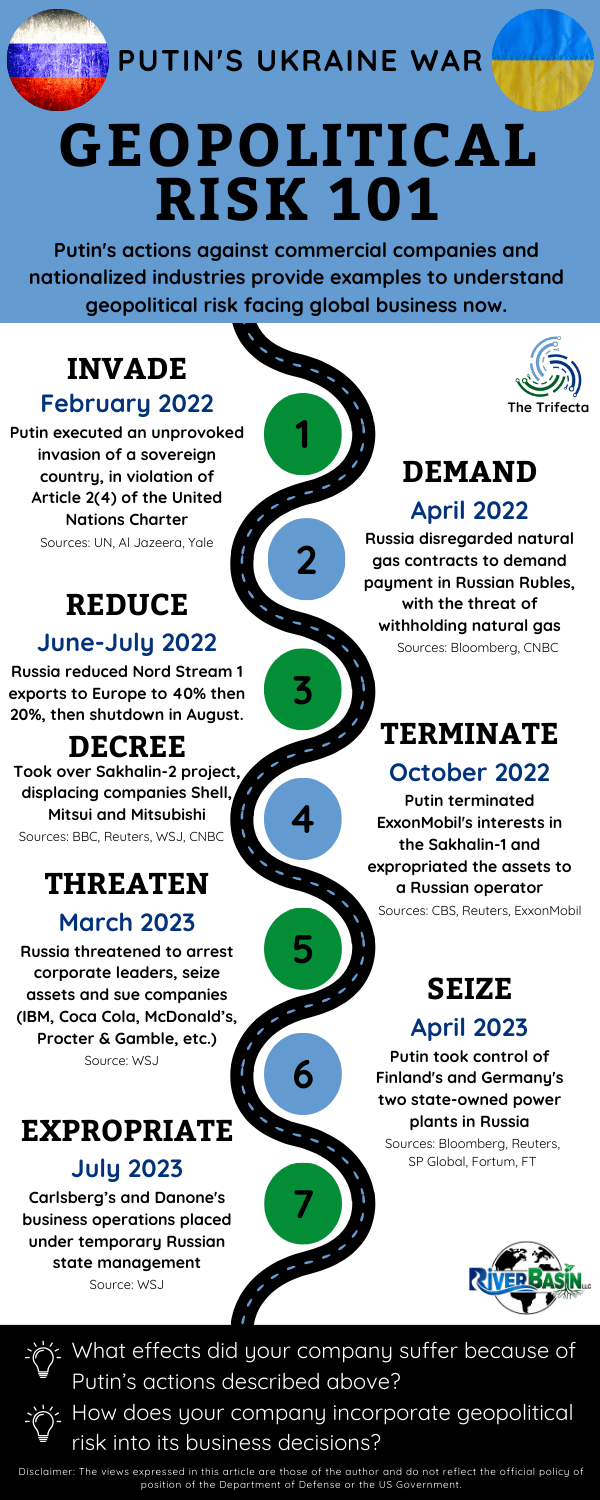

After invading Ukraine, Putin executed a series of geopolitical attacks on industry, which defied the norms businesses expect when operating internationally. A foreign investment in a Joint Venture could be comprised of adversarial capital. Areas of concern identified by the NDIS include real estate, greenfield investments, intellectual property acquisition and licensing, among others.

As energy companies develop new low-emissions technology, new partnerships, investments and opportunities are considered. Applying a lens that evaluates risk of adversarial capital before closing business deals would be prudent.

Production diplomacy reduces risk for companies engaged in it, including energy companies.

A new concept – Production Diplomacy – resulted from the international community’s highly collaborative efforts to supply munitions to Ukraine (see NDIS primer). Production diplomacy involves leveraging economic production and trade relationships to advance diplomatic objectives. Nations use their industrial capabilities, resource distribution and trade networks to foster international cooperation, resolve conflicts, and achieve geopolitical goals.

The NDIS articulates a strategic opportunity learned from the collaborative Ukraine response:

“Incorporating allies and partners into a more networked or web-like production chain would enable expansion in production, additional capacity for a longer contest, and incentives among regional partners to cooperate in resisting coercion from adversaries.”

In the NDIS, production diplomacy is defined as “A production strategy that emphasizes friend-shoring, on-shoring, and working with allies and partners to minimize reliance on products from adversaries.”

In plain language, production diplomacy means that when energy companies work with allies and partners, the two countries become closer and more intertwined at a national level.

By promoting economic interdependence and mutual benefit, production diplomacy aims to strengthen diplomatic ties, enhance global stability, and facilitate peaceful resolution of disputes.

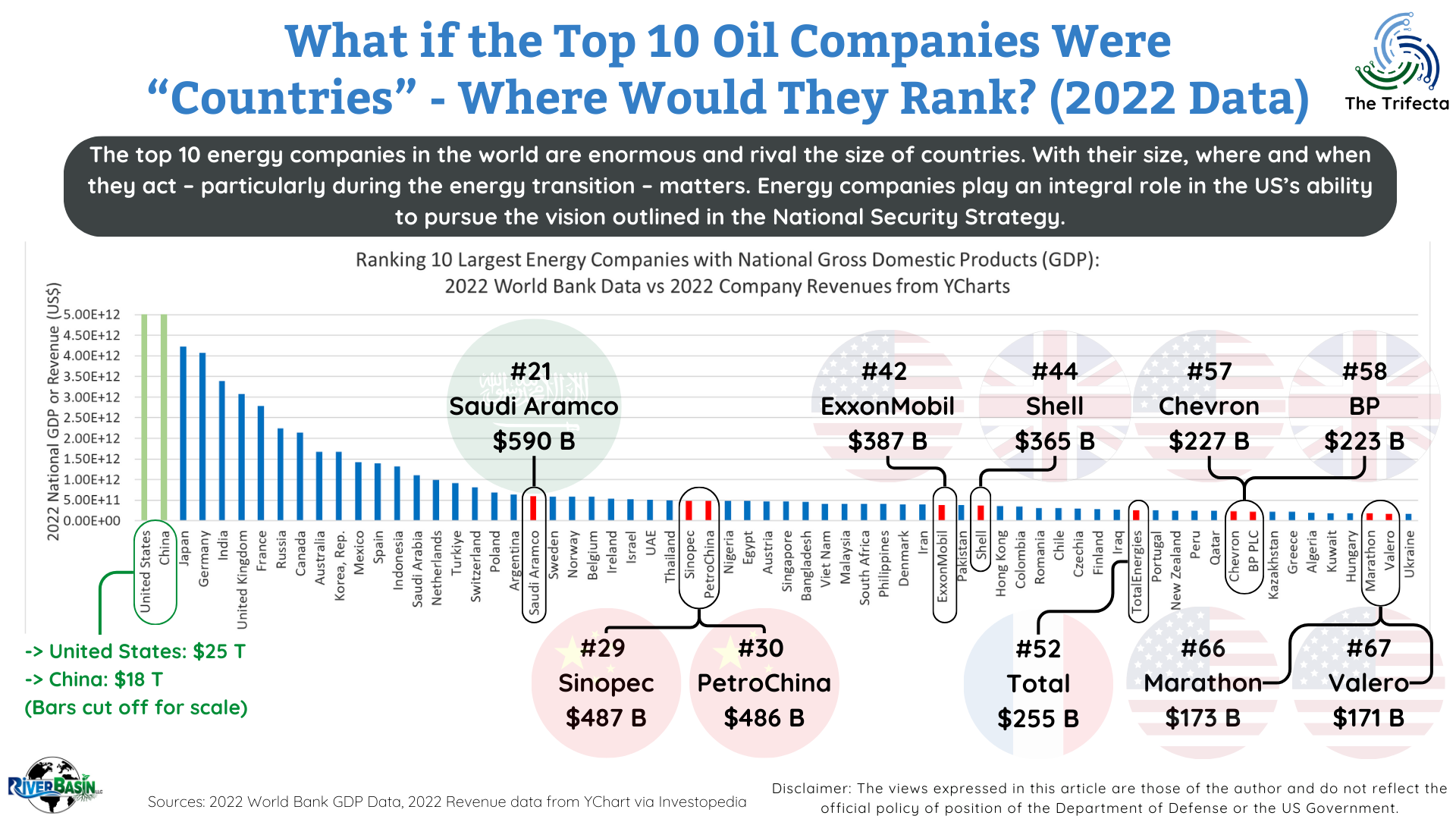

Production diplomacy is related to a topic discussed in an earlier article, “What if the top 10 oil companies were countries?” Where and how energy companies invest and operate matters. Those decisions have ramifications beyond financial ones. They can project soft power, influence regional dynamics, and help build strategic alliances, contributing to a country’s broader diplomatic agenda.

The opposite of production diplomacy is also important. When energy companies work with regimes or in countries that are not allies and partners, they open themselves to risk. Some risk could be related to adversarial capital, as discussed. More broadly, however, the risk likely has many tentacles originating from the country’s government structure, systems, and susceptibility to influence from adversaries, among others. Exploring these risks is extensive and outside this post’s scope.

To be clear, working with allies and partners also includes risk and may include some level of geopolitical risk. The distinction is in the type, scale and potential consequence of the risk.

Friend-shoring reduces geopolitical risk for energy companies.

We are familiar with off-shoring, near-shoring and on-shoring (quick review here). The NDIS introduces a new term, apt for today’s environment of geopolitical risk. Friend-shoring.

According to the NDIS, friend-shoring means “a focus on sourcing from countries that are geopolitical allies.” (p45) It is defined as “a process that engages allies and partners in production and processing of critical and strategic materials and supplies.”

The goal of friend-shoring is to reduce reliance on adversarial or unstable nations for critical defense or strategic materials. By friend-shoring, industry reduces its geopolitical risk. The strategy prioritizes trust, cultural alignment and geopolitical considerations over cost savings alone. When industry collaborates with friendly countries, it enables the respective governments to enhance security, mitigate geopolitical risks, and build stronger diplomatic ties.

For companies, friend-shoring allows them to diversify their supply chains while promoting economic development in ally nations. This approach reinforces mutual interests, strengthens alliances, and fosters a more interconnected and resilient global economy.

Current friend-shoring recommendations

Some existing countries practical for friend-shoring are listed in the NDIS. They include Australia, Canada, the European Union, India, Israel, Japan, Mexico, South Korea, Taiwan and the United Kingdom. This list is not exhaustive.

Multiple variables affect a country’s viability for friend-shoring, according to the NDIS. These include:

- strategic goals

- history

- shared values

- public and political support

- security assurance

- supply chain resilience

- risk diversification

- industrial capabilities

- technological capabilities

The goal is that industry strongly considers friend-shoring whilst evaluating supply chain options. The NDIS recognizes that altering supply chains is time-consuming, difficult, and expensive. Despite this, energy companies exploring new partnerships and investment opportunities for low-emission energy should incorporate friend-shoring into their opportunity evaluation process.

Think About It...

- How do your business operations support production diplomacy?

- Who at your company would evaluate your risk of exposure to adversarial capital?

- Where does your company friend-shore?

- When has adversarial capital impeded your business goals?

- What would it take to increase your company’s amount of friend-shoring?