Let's start with the bottom-line up front (BLUF):

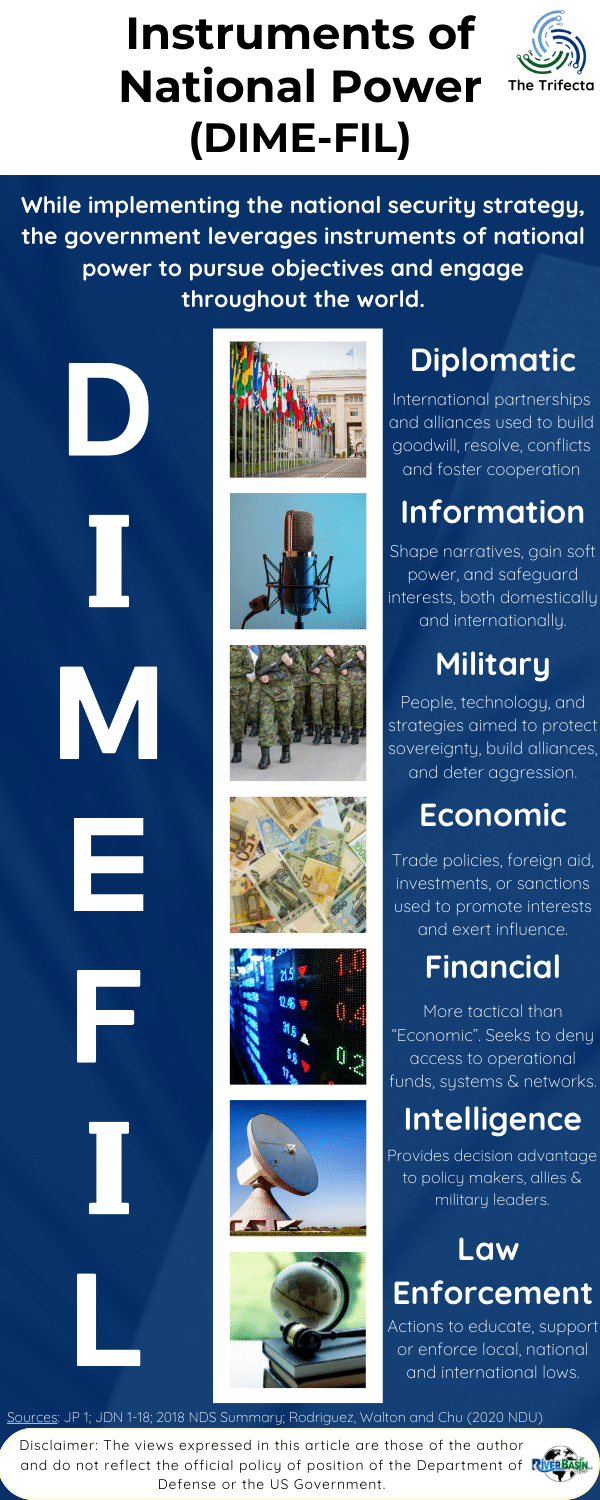

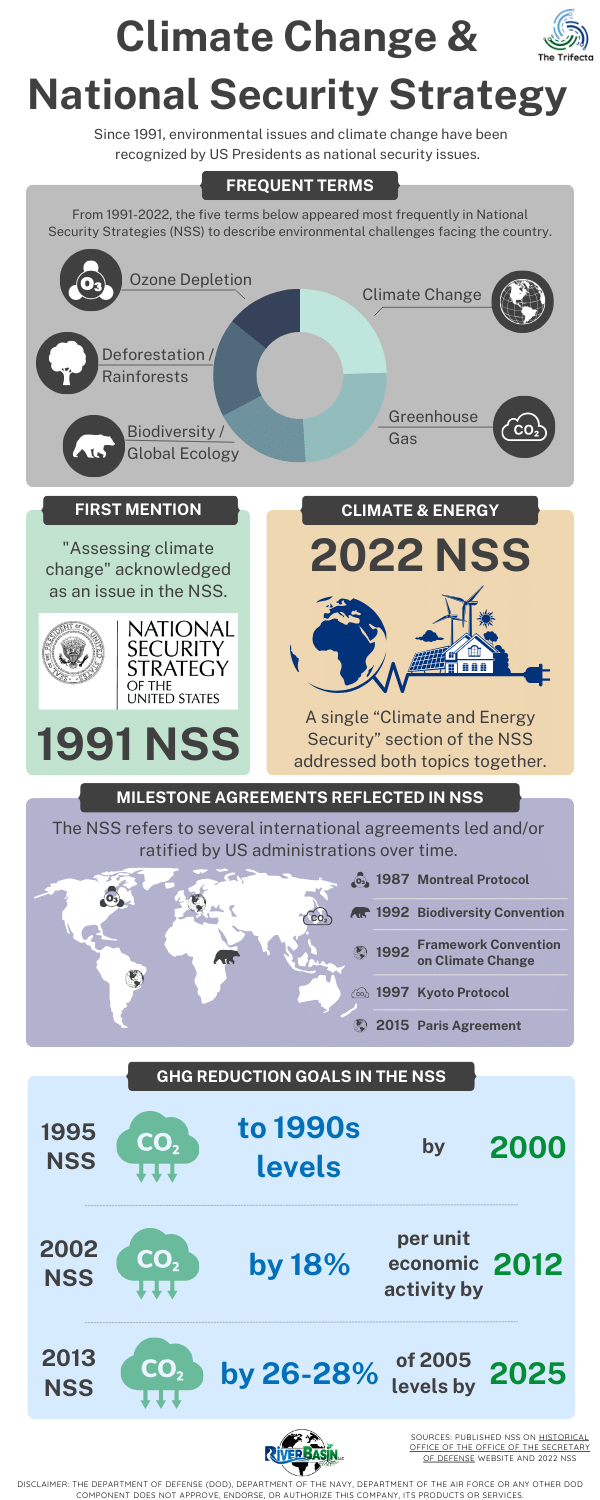

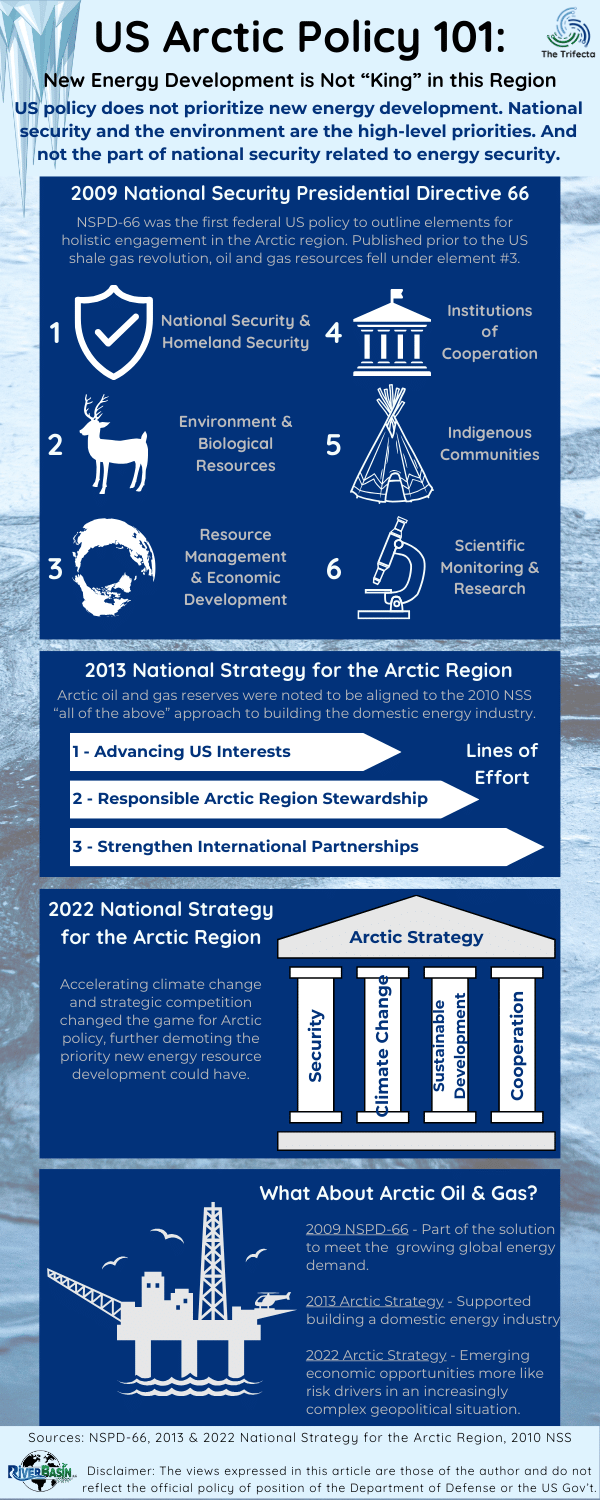

Energy companies must incorporate geopolitical risk into operations and investments to increase resiliency and propagate the energy transition. The developing and complex global geopolitical situation affects energy companies in ways it never has before. These geopolitical risks are also likely to affect the energy transition and efforts to address climate change. Every action in one area impacts the other two areas. The Trifecta will examine the interplay among the three, specifically as it relates to areas where synergies (or challenges) may exist.

Why does this matter?

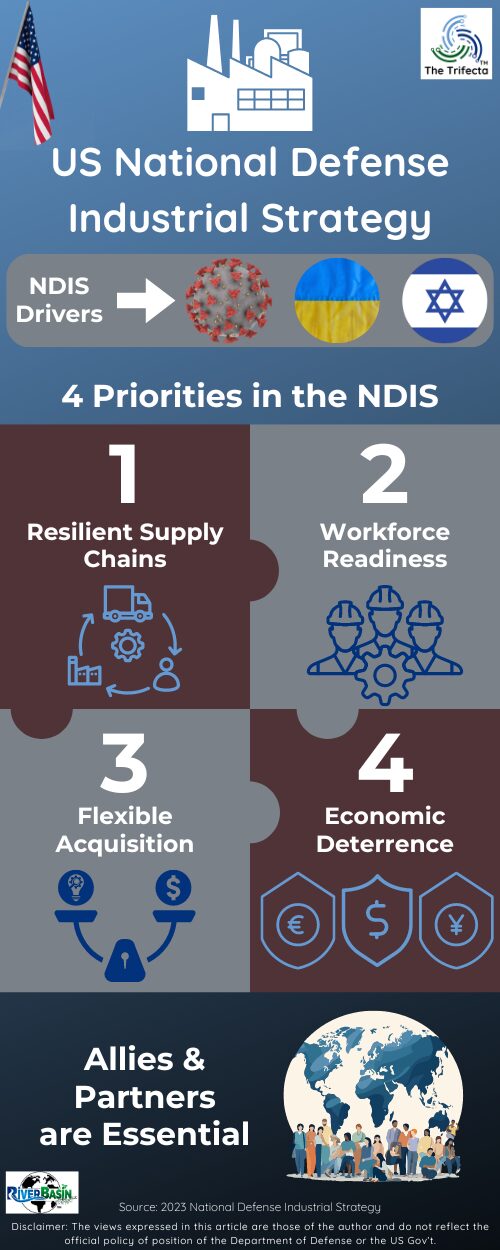

Many energy companies have global operations, a benefit of globalization over the last several decades. Energy companies that don’t incorporate geopolitical risk into their business planning process may find their business impacted in unanticipated ways. Energy companies make significant decisions whilst determining how to navigate the energy transition. In this new era, companies use novel approaches more frequently, adding to uncertainty. General awareness of the interplay between climate change and the energy transition is high. What’s missing however, is including the global geopolitical context in those discussions. Businesses at the vanguard of the energy transition who don’t incorporate global political risk considerations into their decision making face increased risk to profits, operations and investments.

Why "The Trifecta"?

Three hard situations are occurring at the same time: climate change, the energy transition, and evolution of the global geopolitical landscape. Each situation is challenging on its own. The complexity increases dramatically when taken together, where each affects the others.

Key Take-Aways

- The interaction between The Trifecta is intricate, context-dependent, and ever-changing.

- Geopolitical risk is often discoverable and knowable.

- Geopolitical risk is a concern for energy companies in any country, not only the United States (US).

Disclaimers: The views expressed in this article are those of the author and do not reflect the official policy or position of the Department of Defense or the U.S. Government. The appearance of external hyperlinks does not constitute endorsement by the United States Department of Defense (DoD) of the linked websites. The DoD does not exercise any editorial, security or other control over the information you may find at these locations.

The interaction between The Trifecta is intricate, context-dependent, and ever-changing.

We find ourselves in an unfamiliar situation. The global geopolitical situation is uncertain, tense, and multi-dimensional. By itself, this is not new. The novelty lays in the other global phenomenon occurring simultaneously, which both impact and are affected by the geopolitical situation. As the energy transition gains speed, it raises more questions and challenges. Answers to these questions may remain elusive for years. Concurrently, efforts to address climate change are gaining traction. Of course, the energy transition is a key effort to help address climate change but far from the only one.

This blog intends to examine the interplay among these three phenomena. Those unfamiliar with global geopolitics and related policy should expect a learning curve. Not just about jargon and acronyms, but also about history and analytic techniques. The blog will include “primer” material essential for later discussions. Despite the focus on energy companies, the lessons may apply to any company.

The alarm bell I intend to ring is one about geopolitical risk. Geopolitical risk refers to potential disruptions in global political and economic stability caused by factors such as conflicts, trade disputes, or policy changes within or between nations. These risks can impact businesses, economies, and international relations, leading to uncertainty and potential adverse conditions. Since globalization linked economies, supply chains, and people together, there has been a rules-based international order providing predictability. People commonly take this predictability for granted. As we’ll discuss later in much greater depth, that predictability is at risk.

Energy companies should incorporate geopolitical risk into all their business decisions. It won’t be easy. Incorporating geopolitical risk into business decisions is not a one-time event. It requires continuous evaluation, risk management, and discussion, like most business decisions. Existing operations and future business opportunities both need analysis. Energy companies should assign internal resources to support this work. These risk decisions are most analogous to environmental compliance, which is not typically outsourced.

Geopolitical risk is often discoverable and knowable.

Incorporating global geopolitical risk into a business model may require a more concerted effort. It will surely require dedication, resources, focus, and persistence. Depending on several variables, one can discover, analyze, and assess in a structured manner the geopolitical risk impacting a company that will support decision-making. We do this constantly in the military. Thinking about energy companies, some important variables are:

- Company mission and products provided

- Level of granular data a company currently collects on its operations

- Existing awareness of geopolitical events

- Level of risk tolerance by a company

- Company personnel working in geopolitics or adjacent subjects

- Supply chain length and locations

- Array of process and product experts

- Contract structures and lengths

With all the above information (and more), an energy company can reasonably assess the potential geopolitical risk it faces. Some discussion and analysis may seem uncomfortable to those new in this space. Risk implications will vary by company and situation. There is no one-size-fits-all. The complexity of geopolitical risk necessarily prevents businesses from having complete certainty in their decisions. This is where risk management principles come into play.

Geopolitical risk is a concern for energy companies in any country, not just the United States.

The Trifecta will focus primarily on US policy. I live in the US, so I’m most familiar with US policy. That said, we will also embrace critical relationships existing with allies and partners. These relationships are vital to US engagement globally. Deliberately considering these relationships expands our thinking beyond US borders. This is also appropriate because none of the Trifecta is a US-only problem. The Trifecta is a global problem and one we will tackle together…or suffer together.

Businesses headquartered in countries with liberal market economies should support their country’s security objectives. (Security objectives will be discussed more in future posts.) Often, allies and partners have aligned security objectives, which may be one reason they are allies or partners. These similar objects may be clear or easily discoverable on the internet. Sometimes, allies and partners seem to have conflicting objectives, but that may not be the case. Other times, they do have conflicting objectives. In that case, critical thinking and analysis often illuminate common ground between parties. Digging deeper into different perspectives helps all parties gain a better understanding of one’s position. Whilst tackling the Trifecta of global challenges, the more common ground we can all find, the more likely we are to succeed in our endeavors.

Last, I readily acknowledge that politics influence everything happening in the world today. However, this blog will not delve into politics, in accordance with Department of Defense Instruction (DODI) 1344.10, “Political Activities by Members of the Armed Forces.” As a commissioned member of the US Navy Reserve, I must adhere to DODI 1344.10.

Think About It...

- How familiar are you with the current global geopolitical situation?

- How does your company take part in the energy transition?

- Who at your company advocates climate-friendly policies?

- Where in the company are all these issues merged and evaluated holistically? Who does this work? How many people?

DOPSR 23-P-0087